Your bookkeeping software is like a cash register. When you receive money you use the Receive Payments feature to record the payment in Quickbooks Online.

(Innovation Finances) Quickbooks Online is an incredibly powerful business tool when it is properly operated. Managing the leads and sales process can be fairly simple if the estimate feature is used to help win the work from your prospects and leads. Once the deal is closed and you win the lead as a client then you will need to have a process to bill the client for work performed. this is where the process of changing an estimate to an invoice comes in.

Why Receive a Payment in Quickbooks Online?

REASON 1

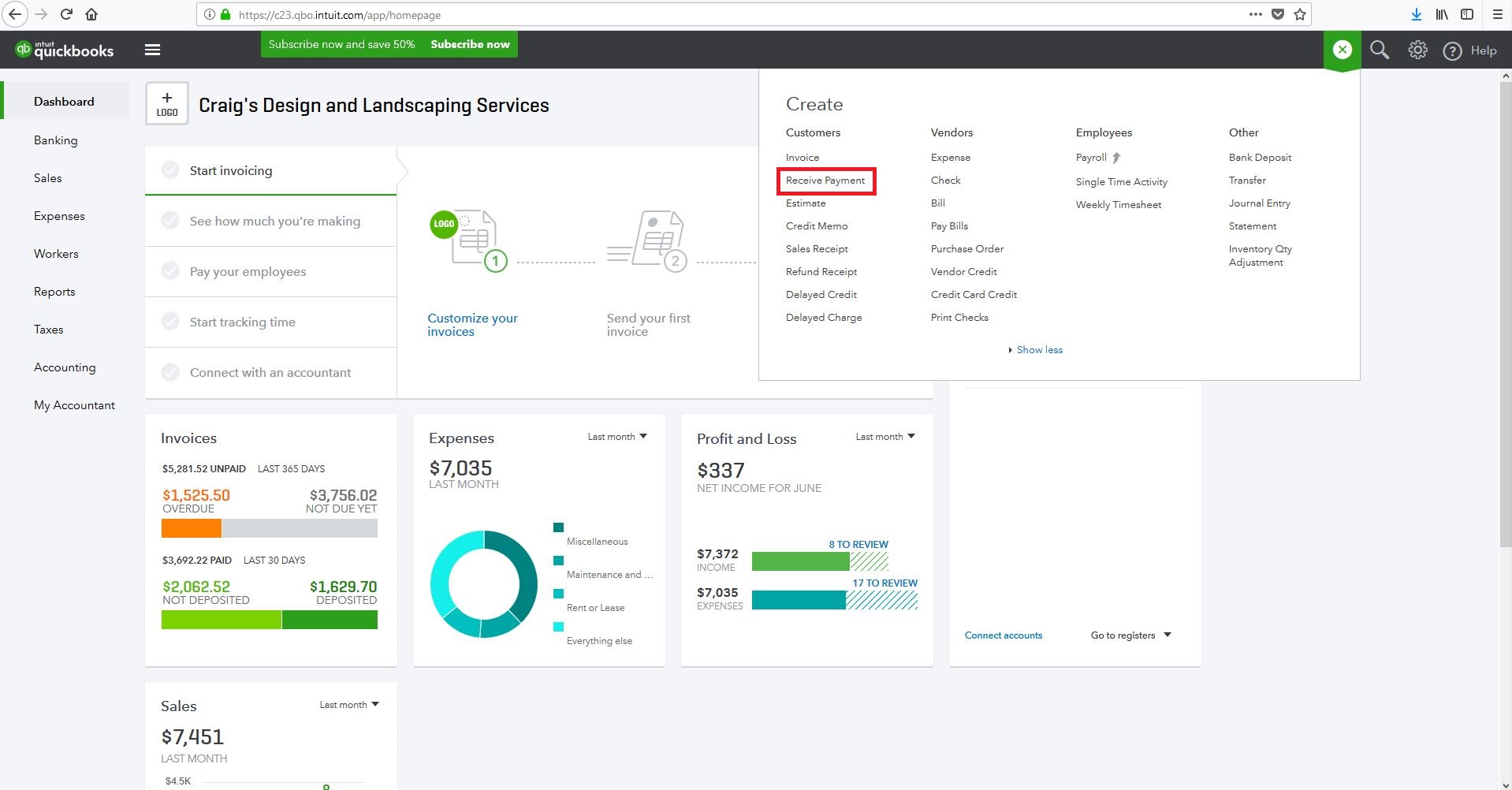

Go to the Plus Sign and create a new Receive Payment form.

STEP 2

A new Receive Payment form will open up. Enter in the basic information such as the client name, payment date, payment method, and deposit to account. It is usually a good idea to use Undeposited Funds as the Deposit to account.

STEP 3

The system will then show you a list of open invoices under the Outstanding Transactions Section. Check the appropriate transaction to match the payment to.

Want to go beyond this article?

To contact us today to learn how Innovation Finances can help!